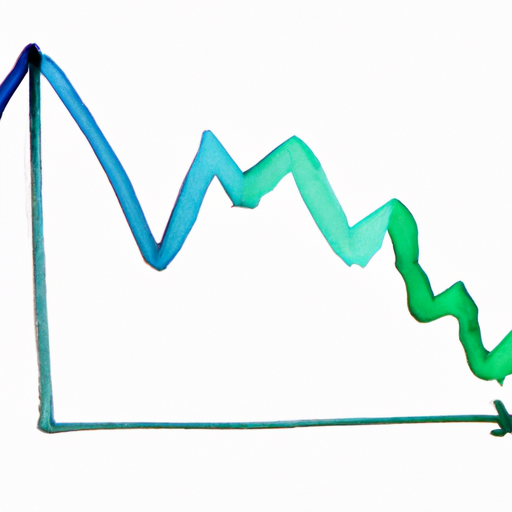

According to the largest mortgage lender in the UK, the Halifax, house prices have seen a decrease of 1% in comparison to a year ago, marking the first annual decline since 2012.

According to the Halifax, which is a member of Lloyds Banking Group, the average price of houses in May decreased by £3,000 compared to the previous year, and it was £7,500 lower than the highest point in August.

The financial institution, which is currently increasing the interest rates on its home loans, stated that elevated borrowing expenses were negatively impacting the trust and assurance of its

In the past few weeks, certain mortgage rates have experienced a significant increase.

Lenders are expecting the Bank of England’s base rate to increase even more, due to the fact that inflation is staying high for a longer period of time than what was previously predicted.

Kim Kinnaird, who works as the director of Halifax Mortgages, stated that the cooling demand for housing would affect the confidence of both buyers and sellers, leading to a shift in their expectations.

Consequently, there is still anticipation for a continuation of a decline in house prices.

According to the Halifax, the mean cost of a house in the United Kingdom is now £286,532. The prices have slightly decreased compared to the previous month. This drop in prices is due to a high market activity in the previous year.

According to the report, the prices in the southern region of England have decreased, while the annual price growth has slowed down in all other areas except for Wales.

The Nationwide, a competing lender, has reported a more significant decrease in housing prices based on their own data. Their data shows that the value of properties has decreased by 3.4% in the year leading up to May, which is the largest decline in 14 years.

First-time homebuyers may welcome the idea, but the higher mortgage rates are reducing their ability to purchase a property beyond their expectations.

Recent data indicates that the increasing expenses of daily life may be hindering individuals from saving money, including setting aside funds for a down payment. UK Finance, an organization that represents banks, reported a decrease in the amount saved in readily accessible savings accounts during the first quarter of the year – the first decline in 15 years.

Various lenders use their own mortgage information to determine their assumptions about the value of houses. While the specifics may differ, both Halifax and Nationwide are predicting a stagnant market and anticipate that property prices will continue to decline.

Are you feeling the effects of increasing mortgage rates? You are welcome to send your personal stories and experiences via email to haveyoursay@bbc.co.uk.

If you are open to talking to a BBC journalist, kindly include a way to contact you such as a phone number. Additionally, there are other methods to get in touch, which are as follows:

Experts from Capital Economics predict that house prices, as measured by the Halifax index, will decrease by 12% from their highest point in August of last year.

Real estate agents are using the recent decrease in the rate of price drops over the past month as an indication that the value of properties may not experience significant further declines.

According to Tom Bill, who is responsible for UK residential research at estate agent Knight Frank, the potential decline in the housing market will not be significant due to several factors. These include increasing wages, low unemployment rates, cash transactions, high levels of equity in homes, longer mortgage terms, and savings accumulated during the pandemic.

According to him, the UK’s housing market is returning to a normal state after a period of significant growth, without experiencing a sudden or drastic decline.

Based on information provided by Moneyfacts, the average interest rate for a new fixed-rate mortgage agreement is 5.79% for a two-year contract and 5.47% for a five-year contract.

The current interest rates are significantly higher compared to their levels before the increase in December 2021. However, they are still lower than the rates that were in place after the mini-budget in the previous

New information from UK Finance indicates that individuals are choosing to take out mortgages with longer terms. The data reveals that a record-breaking one in five first-time homebuyers are selecting mortgages that have a term of over 35 years.

According to UK Finance, customers may be opting for this choice to decrease their monthly payments and enhance their ability to afford it.

As the UK economy grapples with high inflation and increasing interest rates, this announcement has been made.

The OECD has conducted a recent study, which indicates that in the year 2023, Britain will perform better in terms of economic growth than all other developed economies except Germany. The think tank predicts that the UK’s growth rate will increase by only 0.3% this year and will gradually improve to 1% by the year 2024.

The latest forecast is better than the previous one made in March, which predicted a decline of 0.2% for the current year and a 0.9% increase in the following year.

If I fail to make a payment towards my mortgage, what are the consequences? For further information

Similar themes of discussion

Further information on this news item

Housing prices experience the largest decline in nearly 14 years.

The present mortgage expenses are alarming.

The availability of mortgages is shrinking due to increasing interest rates and withdrawal of mortgage deals

Are you wondering if your mortgage payments will increase? Use a mortgage calculator to

Headlines

Ukraine faces severe flooding as 29 communities are submerged following a dam breach.

A video clip shows the rescue operation after a dam in Ukraine was breached. The rescue operation was completed in just 62 seconds.

Prince Harry discovered a tracking device installed on Chelsy’s vehicle.

Characteristics

The reasons behind the 42-year delay in convicting a 90-year-old in India.

What is the reason behind Japan’s new definition of

Chris Christie is attempting to disrupt Donald Trump’s presidential campaign despite the odds being

The color of my skin, which is black, makes me feel like I am not accepted or welcomed in Tunisia.

The information that has been gathered regarding the dam incident

Prince Harry’s statement contained important phrases such as ‚thicko‘, ‚cheat‘, and ‚underage drinker‘.

The account of how the FBI apprehended a well-known spy.

Could the deployment of Storm Shadow missiles by the UK have an impact on the ongoing conflict in

What is the reason behind Putin’s decision to exhibit religious art?

On another part of the BBC, there is a growing trend known as the ‚no-wash‘ movement.

The urban area that is known for being active all night long is

The age group that spends the most time working/

Top articles that are being read the most right now are being featured. The BBC provides different types of news services to its audience. The BBC does not have control over the content that is displayed on external websites. The BBC’s approach to linking