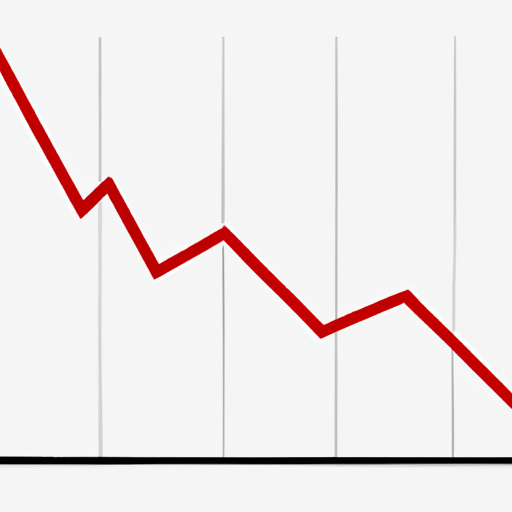

The Halifax, the biggest mortgage lender in the UK, reported that house prices have decreased by 1% from last year. This marks the first annual decline in house prices since 2012.

According to Halifax, which is a part of Lloyds Banking Group, the average price of houses in May decreased by £3,000 compared to the previous year and £7,500 less than the highest point in August.

According to the lender, they are increasing their mortgage rates due to the impact of higher borrowing costs on people’s confidence.

In the past few weeks, certain mortgage rates have increased significantly.

Lenders are expecting an increase in the Bank of England’s base rate due to inflation remaining high for a longer period than originally expected.

According to Kim Kinnaird, the director of Halifax Mortgages, the housing market is experiencing a decline in demand, which is causing both buyers and sellers to readjust their expectations. As a result, this is likely to have a negative impact on confidence in the housing market.

It is still anticipated that house prices will continue to decrease in the future.

Halifax reported that the typical cost of a house in the UK is currently £286,532. They noted a slight decrease in prices when compared to the previous month. The reason for the year-on-year decline was due in part to a flourishing market in the previous year.

According to the report, prices in the southern part of England decreased while all other regions, except for Wales, experienced a decrease in the rate of price growth over the year.

The Nationwide, a competing lender, has reported a more significant drop in house prices based on its own collected information. Last week, they revealed that property worth has decreased by 3.4% within the year leading up to May, marking the most substantial decline in 14 years.

The increase in mortgage rates is causing pressure on the ability of first-time buyers to purchase a property, despite the potential positive effect it may have.

Recent data indicates that the increasing cost of living is probably hindering individuals from saving, including setting aside funds for a down payment. UK Finance, which represents banks, reported a decrease in the amount of money saved in readily accessible savings accounts during the first quarter of the year, marking the first time in 15 years that such a decline has occurred.

Various lenders use their own mortgage data to establish their assumptions on house prices. These assumptions may differ, but both the Halifax and the Nationwide are indicating a stagnant market and anticipate additional decreases in property prices.

Are you feeling the effects of the increasing mortgage rates? We would love to hear your personal experiences. You can send us an email at haveyoursay@bbc.co.uk.

If you are willing to talk to a BBC journalist, kindly provide a contact number. Additionally, you may choose to reach out through any of the following means:

According to the experts at Capital Economics, house prices are expected to decrease by 12% according to the Halifax measure, from the highest point reached in August of last year.

Estate agents suggest that the recent decrease in property prices has slowed down, indicating that the value of properties may not decrease significantly in the near future.

According to Tom Bill, who is responsible for residential research in the UK at estate agent Knight Frank, any potential decrease in the housing market will be balanced out by several factors. These include an increase in wages, a low unemployment rate, a significant amount of cash sales, high levels of equity in housing, longer mortgage terms, and savings accumulated during the pandemic.

According to him, the housing market in the UK is gradually stabilizing after a robust period of three years, instead of suddenly collapsing.

Moneyfacts data shows that the average interest rate for a new fixed-rate mortgage agreement is 5.79% for a duration of two years and 5.47% for a duration of five years.

The current interest rates are significantly elevated compared to their levels before December 2021 when they began to increase. However, they are still lower than the rates that followed the mini-budget announced last autumn.

Recent data from UK Finance reveals a growing trend of individuals opting for longer mortgage terms. The statistics indicate that a historic 20% of first-time homebuyers are now selecting mortgages lasting over 35 years.

According to UK Finance, customers may be selecting this choice as a means of reducing their monthly payments and thus improving their ability to afford them.

As the UK economy grapples with the consequences of increasing inflation and interest rates, this development has arisen.

According to a recent study by the OECD, Britain is expected to outperform every other developed economy except for Germany in 2023. The research indicates that the UK’s growth rate will be 0.3% in the current year, which will increase to 1% in 2024.

The current forecast shows a slight improvement from the previous prediction made in March, which estimated a 0.2% decrease in the current year and a 0.9% increase in the following year.

If I fail to make a mortgage payment, what are the consequences? Learn more by clicking the

Similar Subjects

Further Information on this Topic

The biggest drop in house prices in nearly 14 years has been reported.

The current mortgage expenses are causing fear and concern.

The mortgage market is facing difficulties as interest rates increase and mortgage deals are withdrawn.

Is there a possibility of an increase in my payments using the mortgage calculator?

The main news today is that in Ukraine, twenty-nine different areas have been flooded due to a

A video clip shows a successful rescue operation in Ukraine after a dam breach in just 62 seconds. The rescue team acted quickly and efficiently

Prince Harry revealed that he brought a hacking case to prevent hate towards Meghan.

Characteristics

What caused the 90-year-old’s conviction in India to take 42 years.

What is the reason behind Japan’s new definition of

Chris Christie is attempting to sabotage Donald Trump, despite the odds being against him

The color of my skin, which happens to be black, makes me feel like I am an outsider and do not fit

Information regarding the incident that occurred at a dam in

Prince Harry’s statement included phrases such as "thicko," "cheat," and "underage drinker." These were key extracts from his

The account of how the FBI apprehended a well-known spy.

Is it possible for Storm Shadow missiles from the UK to impact the ongoing conflict in Ukraine?

The reason for Putin showcasing religious artwork has been revealed.

Another article on the BBC discusses the emergence of the "no-wash" trend.

The metropolis that never rests is gradually submerging.

The age group that spends the most time working.

Top stories on BBC News have received the most attention from readers. The BBC is not accountable for any content on external websites, as stated in their external linking policy. The copyright year on the page is 2023.